Guide to Buy a Property in Thailand (2025 Update)

Thailand’s real estate market thrives in 2025, enticing global investors and home buyers with its mix of vibrant cities, scenic coastlines, and affordable prices. While buying property is possible for foreigners, the process—and most importantly, the types of ownership—requires careful consideration to navigate safely and maximize your investment.

Why Consider Buying Property in Thailand?

- Diverse investment options: Condos, villas, and resort homes in tourist hotspots and emerging cities.

- Attractive returns: Strong rental demand and long-term capital appreciation, especially in urban and resort areas.

- Vibrant lifestyle: Affordable luxury, stunning landscapes, and a robust expat community.

Who Can Buy Property in Thailand?

- Foreign buyers can own freehold condos, but direct land ownership is mostly restricted.

- Alternative routes for villas or landed properties: Long-term leasehold, through a well-structured Thai company (with strict legal compliance), or by marrying a Thai national (with limitations).

Step-by-Step: How To Buy Property in Thailand

- Choose location and property type suited to your lifestyle or investment goals.

- Work with a trusted agent and engage a qualified property lawyer.

- Conduct thorough due diligence: Verify property titles, check developer reputation (for off-plan), and inspect boundaries. Related article: How to Do Due Diligence Before Buying in Thailand

- Reserve and secure the property: Sign reservation agreements and place a deposit.

- Sign sales & purchase agreement with a clear payment plan and developer/builder obligation.

- Transfer ownership at the Land Department (for condos or lease registration).

- Pay applicable taxes and transfer fees.

There are many law firms in Thailand. From experience, I can recommend two reputable and very professional firms: Siam Legal and Silk Legal.

Below is a clear and concise video of a real estate agent in Thailand explaining how foreigners can buy property in Thailand.

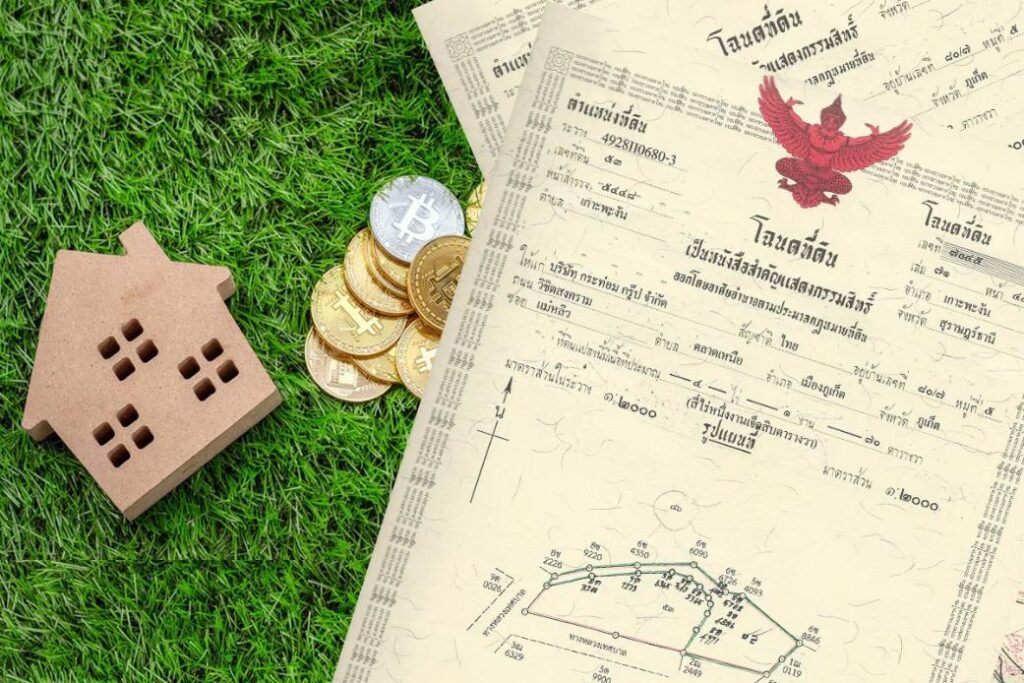

Property Title Types in Thailand: Comparison Table

Understanding title deeds is crucial. The following table summarizes the major property title types for buyers:

| Title Deed Type | Thai Name (Abbr.) | Description | Ownership Rights | Foreign Eligibility | Notes |

|---|---|---|---|---|---|

| Freehold Title Deed | Chanote (Nor Sor 4 Jor) | Best, most secure title. Full physical ownership, GPS-surveyed borders. | Full ownership, sell, lease, mortgage | Condos only (direct), land not direct | Strongest, preferred title |

| Confirmed Possessory Right | Nor Sor 3 Gor | Rights close to ownership, boundaries measured, convertible to Chanote | Sell, lease, mortgage, build | Condos only (direct), land not direct | Can be upgraded to Chanote |

| Possessory Right | Nor Sor 3 | Right to use land, boundaries not officially measured, weaker than above | Sell, lease (limited), not full owner | Not recommended for foreigners | Can be upgraded with process |

| Possessory Certificate | Sor Kor 1 | No registered ownership, only possession. Easily disputed or revoked | Little to no legal protection | Not suitable | Avoid for investment |

| Leasehold | N/A | Long-term lease (up to 30 years, renewable). Most common for villas/land for foreigners. | Use, build, sub-let (if allowed) | Yes | Not true ownership |

Freehold vs Leasehold: Quick Comparison Table

| Feature | Freehold Condo | Leasehold Property |

|---|---|---|

| Ownership Duration | Perpetual | Typically 30 years, renewable |

| Foreign Ownership Cap | 49% per condo project | None (as leaseholder) |

| Resale Value | High | Lower (as time reduces) |

| Rights | Full ownership; can sell, lease, mortgage | Right to use, sublet (depends on contract) |

| Usual Use | Condos | Villas, land |

Key Legal Steps and Costs Table

| Step | Typical Fees/Taxes | Process Notes |

|---|---|---|

| Reservation & Deposit | Reservation fee (5–10%) | Paid to developer or seller |

| Due Diligence & Lawyer Fee | Legal fees (varies, ~$1,000–$2,000) | Highly recommended for all foreign buyers |

| Transfer & Registration | Transfer fee (~2%), stamp duty, taxes | Paid at Land Department on transfer date |

| Ongoing Management | Condo fees, maintenance, property taxes | Varies by property, location |

Current Market Trends (2025)

- Urban condos with smart and eco features are in high demand among foreign investors.

- Resort and “workation” real estate is booming in coastal areas.

- Off-plan and pre-construction units often offer lower prices and flexible payment terms but require extra due diligence.

- Secondary cities see growing expat and investment interest for affordability and lifestyle. Related article: Top 5 Places to Buy Property in Thailand in 2025

Frequently Asked Questions

Can foreigners buy villas or land?

Foreigners cannot directly own land but can lease it for up to 30 years (renewable), or set up a properly structured company (with restrictions) to hold land titles.

What documents are required for foreign buyers?

Passport, proof of overseas funds, sales & purchase agreement, legal paperwork on property/title.

Are there special visas for property buyers?

Yes—programs like the Thailand Elite Visa support long-term stays for real estate investors.

Expert Tips For Safe Buying

- Always use a qualified lawyer for due diligence on title and contracts.

- Verify the property title type—always prefer Chanote for land.

- Only buy condos in developments with available foreign quota.

- Transfer all purchase funds from overseas in foreign currency, with proof for the Land Department.

- Avoid unregistered or possessory right lands—they are insecure for investment or long-term living.

With sustained market growth, updated legal frameworks, and transparent buying options, Thailand remains a rewarding destination for global property buyers in 2025—just be informed, cautious, and work only with reliable professionals.

Articles you could be interested in:

- 7 Common Mistakes to Avoid When Buying Property in Thailand

- How does the process of buying a condo as a foreigner differ from buying a leasehold property?

- What Taxes Do You Pay When Buying Property in Thailand?

- How to Finance Your Property Purchase in Thailand

- How to Manage Your Property in Thailand Remotely

- Condos, Villas, or Land: What Should You Buy in Thailand?

- Top 5 Places to Buy Property in Thailand in 2025

- How to Avoid Scams When Buying Property in Thailand